It is an indirect way to save or ‘shield’ cash flows from taxes through the use of depreciation. Tax shields allow for taxpayers to make deductions to their taxable income, which reduces their taxable income. The lower the taxable income, the lower the amount of taxes owed to the government, components of an internal control system hence, tax savings for the taxpayer. The IRS allows you to reduce your taxable income by a specific dollar amount—called a standard deduction. Your standard deduction can help lower your tax liability, especially for those who don’t have tax-deductible expenses, as outlined above.

How Accelerated Depreciation Works On Tax Savings?

Their benefits depend upon the taxpayer’s overall tax rate and cash flow for the given tax year. In addition, governments often create tax shields to encourage certain behavior or investment in certain industries or programs. Depreciation tax shields are important because they can improve a company’s cash flow by reducing its tax liability. They also make capital-intensive investments more attractive because the higher the investment in depreciable assets, the greater the potential tax shield. A depreciation tax shield is a tax-saving benefit applied to income generated by businesses.

A Beginner’s Guide to Effective WhatsApp Marketing in 2024

Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington. Sandra’s areas of focus include advising real estate agents, brokers, and investors. She supports small businesses in growing to their first six figures and beyond. Alongside her accounting practice, Sandra is a Money and Life Coach for women in business. Tax evasion occurs when people intentionally fail to report their revenue or income to the proper taxing authority, such as the Internal Revenue Service (IRS).

Navigating Crypto Frontiers: Understanding Market Capitalization as the North Star

Suppose we are looking at a company under two different scenarios, where the only difference is the depreciation expense. The real cash outflow stemming from capital expenditures has already occurred, however in U.S. GAAP accounting, the expense is recorded and spread across multiple periods. With the two methods clarified, let’s look at the Cash Flow impact of each approach.

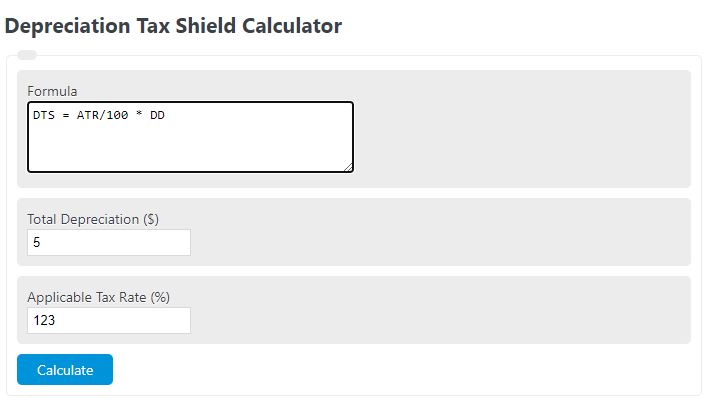

The taxes saved due to the Interest Expense deductions are the Interest Tax Shield. Beyond Depreciation Expense, any tax-deductible expense creates a tax shield. So, for instance, if you have $1,000 in mortgage interest and your tax rate is 24%, your tax shield will be $240. For example, if a company has an annual depreciation of $2,000 and the rate of tax is set at 10%, the tax savings for the period is $200. If you don’t report every element of your income—including bonuses paid by your employer and tips—then you are guilty of tax evasion. If you deliberately claim specific tax credits that you’re not eligible for, then you are committing tax fraud.

How Is Tax Shield Interest Calculated?

- Below, we take a look at an example of how a change in the Depreciation method can have an impact on Cash Flow (and thus Valuation).

- Taxpayers can either reduce their taxable income for a specific year or choose to defer their income taxes to some point in the future.

- The tax shield is a very important aspect of corporate accounting since it is the amount a company can save on income tax payments by using various deductible expenses.

- The real cash outflow stemming from capital expenditures has already occurred, however in U.S.

- The ability to use a home mortgage as a tax shield is a major benefit for many middle-class people whose homes are major components of their net worth.

Although it is not an actual expense that you are writing off, it is lowering the income you have to pay taxes on, and, ultimately, you will have less expenses in the end. A depreciation tax shield is not about how much money you make, but rather how much money you get to keep. Just like the name implies, it shields you from tax obligations before the government.

This alternative treatment allows for the use of simpler depreciation methods for the preparation of financial statements, which can contribute to a faster closing process. A tax shield refers to tax deductions that an individual or business can take to lower their taxable income. Although tax shields have traditionally been used by wealthy individuals and corporations, middle-class individuals can also benefit from tax shields. This a tax reduction technique under which depreciation expenses are subtracted from taxable income.is is a noncash item, but we get a deduction from our taxable income.

This article is not intended to provide tax, legal, or investment advice, and BooksTime does not provide any services in these areas. This material has been prepared for informational purposes only, and should not be relied upon for tax, legal, or investment purposes. BooksTime is not responsible for your compliance or noncompliance with any laws or regulations. To wrap this up, we hope you now have a much better understanding of the Depreciation Tax Shield Calculation as well as the underlying concept. First, when a Company borrows money (or ‘Principal’) from a Lender, they typically agree to repay the borrowed dollars in the future.

A tax shield is a fully legal strategy that taxpayers can use to reduce their tax burden and should not be confused with tax evasion. Tax evasion, also known as tax fraud, is the illegal and intentional failure to pay the full tax balance owed to the U.S. government. Itemized deductions allow you to deduct the dollar amount of various expenses, such as interest on student loans and mortgages. If your total allowed deductions are higher than your standard deduction, you might be better off itemizing, meaning you wouldn’t take the standard deduction.

Leave a Reply