The inventory valuation method that you choose affects cost of goods sold, sales, and profits. Choosing the right inventory accounting method can significantly influence a company’s essential bookkeeping tips for your photography business financial health and tax obligations. FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) are two prevalent methods that businesses use to manage their inventories.

- This can be advantageous in times of rising prices, as the cost of goods sold (COGS) will reflect the higher recent costs, thereby reducing taxable income.

- Companies with perishable goods or items heavily subject to obsolescence are more likely to use LIFO.

- Since LIFO uses the most recently acquired inventory to value COGS, the leftover inventory might be extremely old or obsolete.

- Freeze Frame Camera Shop uses the lower-of-cost-or-market basis for its inventory.

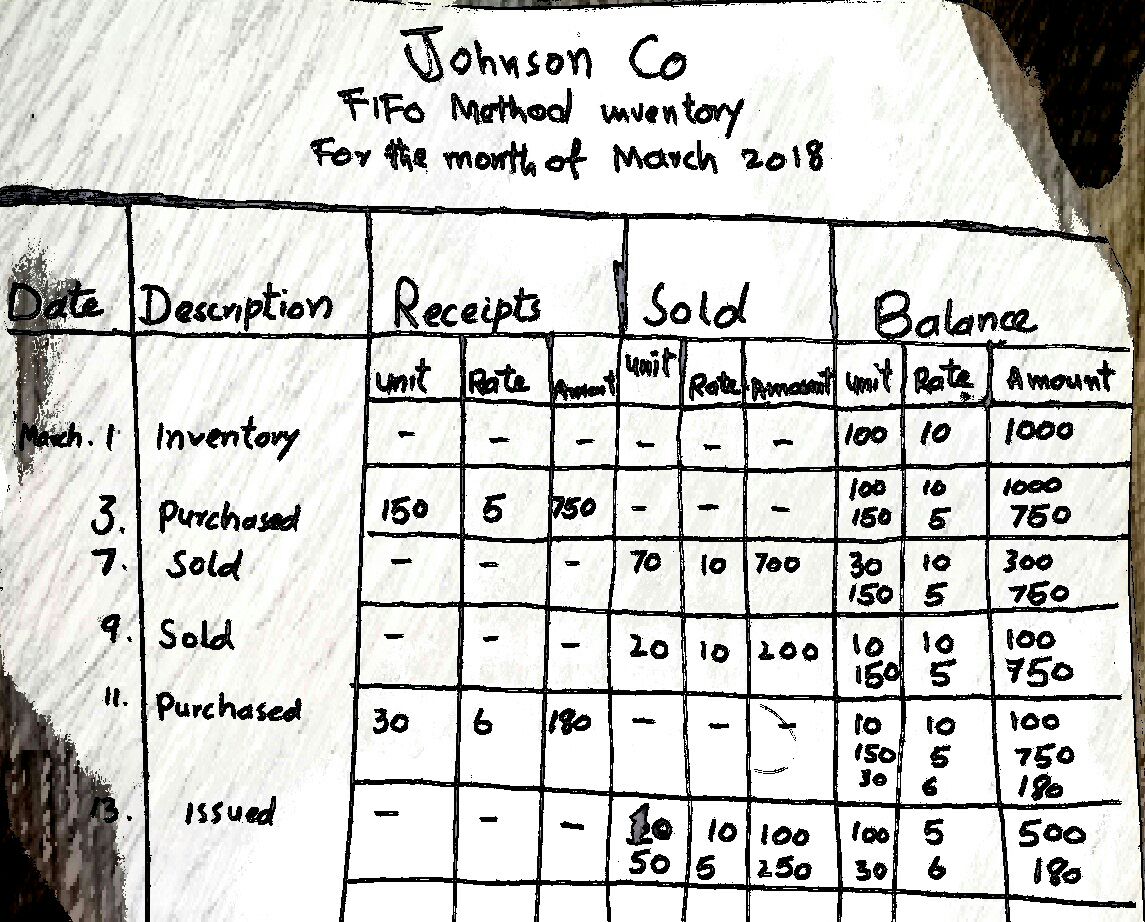

Weighted Average vs. FIFO vs. LIFO: An Example

With this accounting technique, the costs of the oldest products will be reported as inventory. It should be understood that, although LIFO matches the most recent costs with sales on the income statement, the flow of costs does not necessarily have to match the flow of the physical units. The oldest, less expensive items remain in the ending inventory account. The store’s ending inventory balance is 30 of the $54 units plus 100 of the $50 units, for a total of $6,620. The sum of $6,480 cost of goods sold and $6,620 ending inventory is $13,100, the total inventory cost.

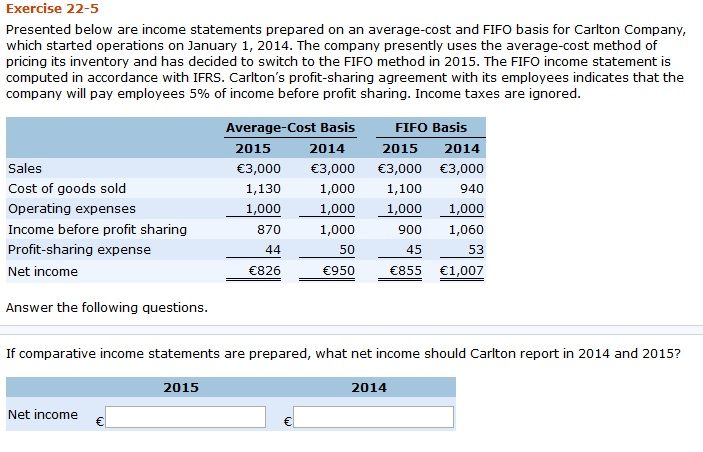

Instructions

Businesses would use the FIFO method because it better reflects current market prices. This is achieved by valuing the outstanding inventory at the cost of the most recent purchases. The FIFO method can help ensure that the inventory is not overstated or understated. LIFO is more difficult to account for because the newest units purchased are constantly changing. However, if there are five purchases, the first units sold are at $58.25.

FIFO vs. LIFO Accounting: What is the Difference?

The First-In, First-Out (FIFO) method assumes that the first unit making its way into inventory–or the oldest inventory–is the sold first. For example, let’s say that a bakery produces 200 loaves of bread on Monday at a cost of $1 each, and 200 more on Tuesday at $1.25 each. FIFO states that if the bakery sold 200 loaves on Wednesday, the COGS (on the income statement) is $1 per loaf because that was the cost of each of the first loaves in inventory. Using FIFO the company assumes that first costs (the oldest costs) for 70 units will be removed from inventory and will become the cost of goods sold. Therefore, the FIFO cost of the 70 units sold had a cost of $2,950 [30@$40 + 30@$43 + 10@$46].

LIFO vs. FIFO: Inventory Valuation

When all inventory items are sold, the total cost of goods sold is the same, regardless of the valuation method you choose in a particular accounting period. When sales are recorded using the LIFO method, the most recent items of inventory are used to value COGS and are sold first. In other words, the older inventory, which was cheaper, would be sold later. In an inflationary environment, the current COGS would be higher under LIFO because the new inventory would be more expensive.

LIFO better matches current costs with revenue and provides a hedge against inflation. FIFO and LIFO inventory valuations differ because each method makes a different assumption about the units sold. To understand FIFO vs. LIFO flow of inventory, you need to visualize inventory items sitting on the shelf, each with a cost assigned to it. FIFO has advantages and disadvantages compared to other inventory methods. FIFO often results in higher net income and higher inventory balances on the balance sheet. However, this results in higher tax liabilities and potentially higher future write-offs if that inventory becomes obsolete.

So ultimately, the benefit of using the FIFO method for a company is that it can report a higher value of shareholders’ equity or net worth and hence appear more attractive to the investors. On the other hand, a company that uses the LIFO method will be reporting a lower value of net worth and hence will appear comparatively less attractive to the investors. In addition to tax deferment, LIFO is beneficial in lowering the instances of inventory write-downs. Inventory write-downs happen if the inventory has decreased in price below its carrying value.

Use QuickBooks Enterprise to account for inventory using less time and with more accuracy. QuickBooks allows you to use several inventory costing methods, and you can print reports to see the impact of labor, freight, insurance, and other costs. With QuickBooks Enterprise, you’ll know how much your inventory is worth so you can make real-time business decisions. The FIFO and LIFO compute the different cost of goods sold balances, and the amount of profit will be different on December 31st, 2021.

Leave a Reply