Since processes are continuous, when a cost of production report is prepared, the unfinished units in the opening work in process or closing work in process are assigned an estimated percentage of completion. Based on this percentage of completion, number of equivalents units is calculated in order to find cost per completed unit. First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period. Then, we compare the total to the cost assignment in step 4 for units completed and transferred and ending work in process to get total units accounted for.

What Does Equivalent Units of Production Mean?

For example, if costs are going up, the cost of those 750 pie shells in beginning work in process inventory would be less than the cost of the 1,000 pie shells in ending inventory. According to the accounting records, direct materials transferred to the mixing department were costed at $3,575 and direct labor and factory overhead were $3,640. The mixing department started another 3,250 shells during February, and at the end of the month, there were still 1,000 shells being mixed and prepped for baking. They were only 25% complete as to conversion but 100% of the direct materials had been added (because they are added at the beginning of the process). Essentially, the concept ofequivalentunits involves expressing a given number ofpartially completed units as a smaller number of fully completedunits.

3: Equivalent Units (Weighted Average)

One thing to keep in mind when using the weighted average method, we don’t need to compute the equivalent units for the ones transferred out. Those are considered 100% complete for the work done in that department, otherwise they wouldn’t be moving forward to the next process. Under FIFO, remember to bring over the costs of beginning work in process first, then multiply the individual equivalent units calculated in step 2 (not the total equivalent units) by the cost per equivalent unit from step 3.

Formula for Equivalent Units of Production

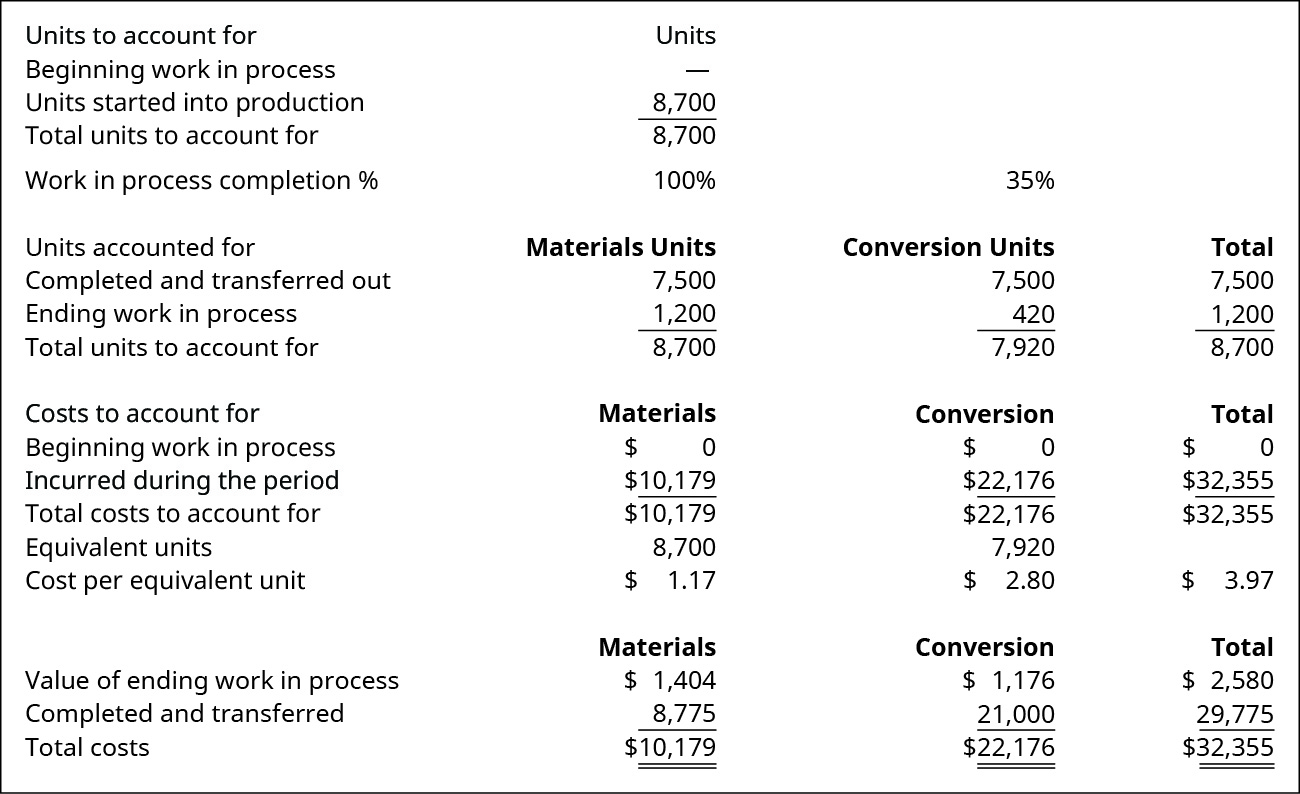

Since the maximum number of units that could possibly be completed is \(8,700\), the number of units in the shaping department’s ending inventory must be \(1,200\). The total of the \(7,500\) units completed and transferred out and the \(1,200\) units in ending inventory equal the \(8,700\) possible units in the shaping department. The shaping department completed 7,500 units and transferred them to the testing and sorting department.

Example

No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections. Since the maximum number of units that could possibly be completed is 8,700, the number of units in the shaping department’s ending inventory must be 1,200. The total of the 7,500 units completed and transferred out and the 1,200 units in ending inventory equal the 8,700 possible units in the shaping department. Therefore, the started and completed unit of 75,000 units was computed by deducting the ending WIP (5,000 units) and beginning WIP (10,000 units) from the total units to account for of 90,000 units. Mathematically, this is done by converting the partially completed units into fully completed units and then adjusting the output figure. To measure output accurately, these partially completed units must be considered in the output computation.

- In continuous processes, there is work-in-progress at the beginning and end of a period, as well as a degree of completion of closing work-in-progress.

- So our equivalent units of production for the period would be 850 units.

- It’s useful for companies making large quantities of similar products because it helps them understand cost per item.

For example, in the case of chocolate bars, conversion costing means the cost for mixing, molding, and packaging. Work In Progress (WIP) are the products that are still being made and not finished yet. In the case of chocolate bars, WIP means the bars that are partially retirement income made and not ready to be sold. The shaping department completed \(7,500\) units and transferred them to the testing and sorting department. No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections.

For those units that were in the beginning inventory, we need to figure out how much work was DONE on them in this period to get them to the point of being transferred to the next process. For those items in the ending inventory, it is the same as the weighted-average method, where we need to calculate how much work has been done to them already. Our equivalent units of production for the period is 1,200 units (700 + 500). If the closing work-in-progress is 800 units, 70% complete in all respects, the equivalent units of production of closing work-in-progress is 560 units (i.e., 800 x 70%).

In continuous processes, there is work-in-progress at the beginning and end of a period, as well as a degree of completion of closing work-in-progress.

For total equivalent units, this is the sum of the units transferred out, with your ending inventory. At the end of process 1, our planners have their paper and ink ready to be printed. Let’s assume we figure the ending WIP inventory to be 35% complete as to the process. If we have 1000 units in the ending WIP inventory after process 1, this would equal 350, using the formula for equivalent units.

On the other hand, the Weighted-Average method blends all the costs together to find an average cost per unit. So, if the factory had different costs for chocolate bars at different times, the Weighted-Average method would add up all the costs and divide by the total number of bars produced to get a single average cost per bar. This makes it easier to calculate costs when there are many different costs over a period. Establish the total inventory in production by adding units started into production to beginning work in process (what was left only partially finished at the end of the prior month).

Leave a Reply